Overview

Direct access to client banking data from multiple sources

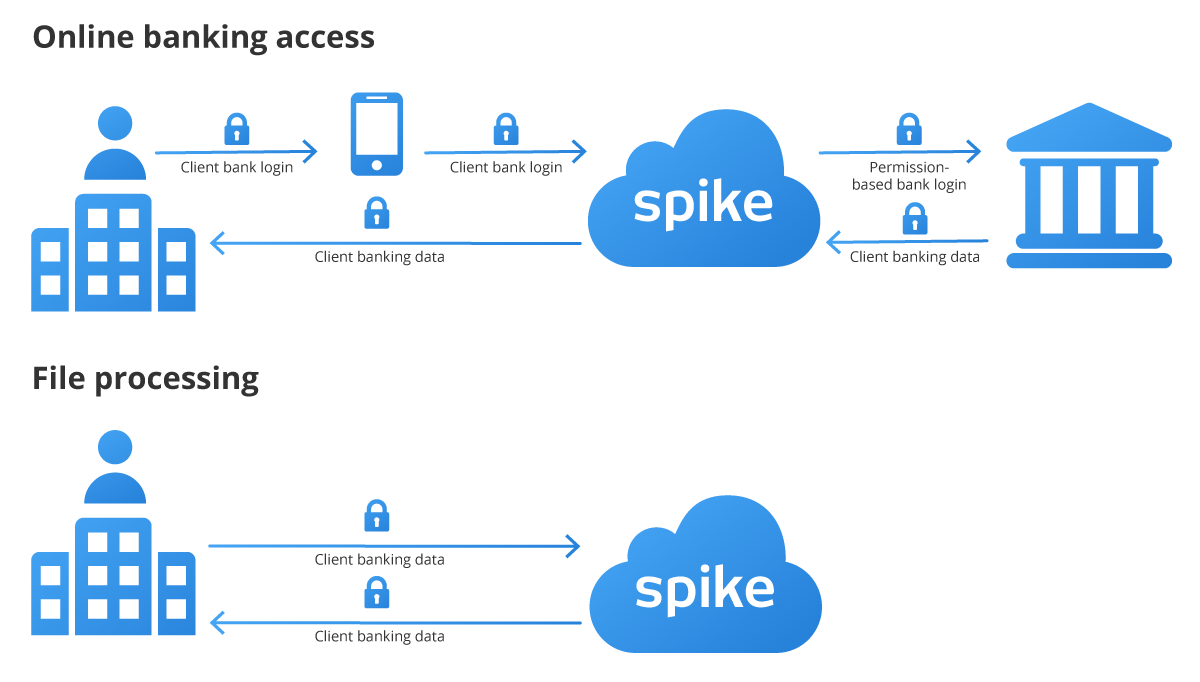

Spike’s interface for financial institutions facilitates permission based access to client banking data. After access is granted by the account holder, the Spike API acquires bank account information and banking transaction data in real-time for verification, lending and budgeting purposes. Alternatively, automate the processing of PDF or image based statements to acquire banking data for further analysis.

Banks supported

Instant access to data

The Spike API allows real-time access to banking data via permission based login. Our file processing system instantly converts customer statements into useful structured data.

Seriously secure

We don’t store passwords or any personally identifiable information and all data is transmitted using bank-level encryption.

South African Fintech

As a South African FinTech company, we develop, license and support our own software, which allows us to be highly responsive to local requirements.

Development service

The Spike software development team is also able to assist clients with software integration and custom functionality.

Banking data acquisition features

Online banking access

$ 0.00

Per MonthAccess to client banking data via permission based login- Account holder information

- List all accounts and balances

- 90 day transaction history

- Archived history statement *

- Branded e-statement

File processing

$ 7.99

Per MonthUpload PDFs or Image files for automated processing- Account holder information

- Transaction history

- Monthly PDF statements

- OCR/Scanned statements

* Some banks may charge the account holder

We take security seriously

Data encryption

All requests are transmitted over secure connections using bank-level security.

Security audits

Spike software is regularly audited by leading independent cyber security firm, Exocet Security, who has certified the banking API against the most stringent security standards.

Secure environment

Spike technology is cloud-based and secured by AWS, which meets PCIDSS/HIPAA server security standards. This robust infrastructure is also highly scalable allowing us to meet all future capacity needs.

Data privacy

Spike adheres to South Africa’s POPIA data privacy standards. The banking API never stores user login details, which means user data can never be compromised.

Contact us

Please contact us if you’d like like to know more about our services or would like to setup a demo.

Cape Town

WeWork Cape Town

80 Strand Street, Cape Town, 8000

[email protected]